Proving a return on investment (ROI) is a necessity for any business expense.

Spending time on a project or buying software should be an investment—you’re hoping to get more back than you put in. And since time and money are limited resources, there’s a natural need to justify how you’re spending both to show that your investments are valuable.

That’s great, and sometimes easy for business functions that are directly generating revenue. For the areas that don’t, it’s a dilemma. How can you prove ROI if you can’t tie it directly to dollars?

Customer surveys are a great example of this dilemma. Some teams might be tempted to think that surveys, and the tools needed to send them, aren’t all that important for your business. But that’s flawed thinking. Customer surveys have the potential to produce a considerable ROI.

Start your day

with great

quality

content

The problem is that most companies that use customer surveys don’t know if they’re actually getting an ROI. It’s not that they don’t have an ROI—it’s that the ROI can be more difficult to measure.

Consider a CSAT rating or an NPS score. These are both widely used KPIs, but they usually suffer from having small sample sizes. Since only a small portion of your customers respond to these surveys, proving that their feedback is worth listening to can be challenging. And if you can’t prove their input is valuable, you’ll never see a return on your investment.

Many customer support leaders assume that the solution lies in collecting more data. If you just had more data available, you could easily convince other teams in the company to act on it, thereby providing that elusive ROI that you’re looking for.

It isn’t quite that simple.

3 essential steps to prove the ROI of your customer surveys

The real problem with customer surveys happens when companies collect the data and then don’t use it for anything. It’s tempting to view positive feedback as a pat on the back and walk away from the negative ones with a shrug or the thought, “Fair enough. Maybe we can work on that later.”

The value in customer surveys lies exclusively in how you use the information. It’s your decisions about what to do with your customer feedback that create a return on your investment.

With that in mind, there are three steps to proving the ROI of customer surveys. Investing in these three steps is essential for you to make the best possible decisions regarding your customer experience:

- Solicit feedback from your customers

- Understand how metrics impact business outcomes

- Translate that feedback into meaningful action

Solicit feedback from your customers

You’re probably already soliciting feedback from your customers in some fashion.

If your customer surveys are well-designed and placed, they can be a great vehicle for understanding market fit and product impact. But all voluntary feedback methods suffer from one fundamental problem: self-selection bias.

It’s a good idea to work on increasing your response rates, and you can try to reduce how much self-selection bias impacts your results, but that bias will never totally disappear. That doesn’t invalidate your data.

Here’s why.

The customers who self-select are engaged. Whether they’re struggling or not, they’re the ones who care enough to spend a little extra time to let you know what they think.

Sometimes they’re engaged because they’re furious, like when they haven’t been able to use your product like they hoped, and they complete a rage-filled NPS survey swearing they’ll never recommend your product.

Other times, they’re engaged because they love your product. They’ve made your product part of their workflow and have seen the value, so now they care about your brand and your future product development.

These engaged customers are the ones you can access to get qualitative data from your customers. They opt themselves in, whether it’s because they’re happy or unhappy. And while the sample size may be small, this group’s feedback will usually represent your broader customer base. For example, only 1 out of 26 unhappy customers complain.

That means even having that one angry customer complete a survey has the potential to transform your business (as long as you never forget there may be a lot of others that feel the same way!).

Customer feedback is innately valuable because every business exists to serve its customers. But you can’t stop there.

Understand how metrics impact business outcomes

This is the most difficult step, but it’s also the most impactful.

Here’s a secret.

Getting past the sample size dilemma is only challenging because translating the metrics you measure in a customer survey to a business outcome is complicated.

Say you measure NPS:

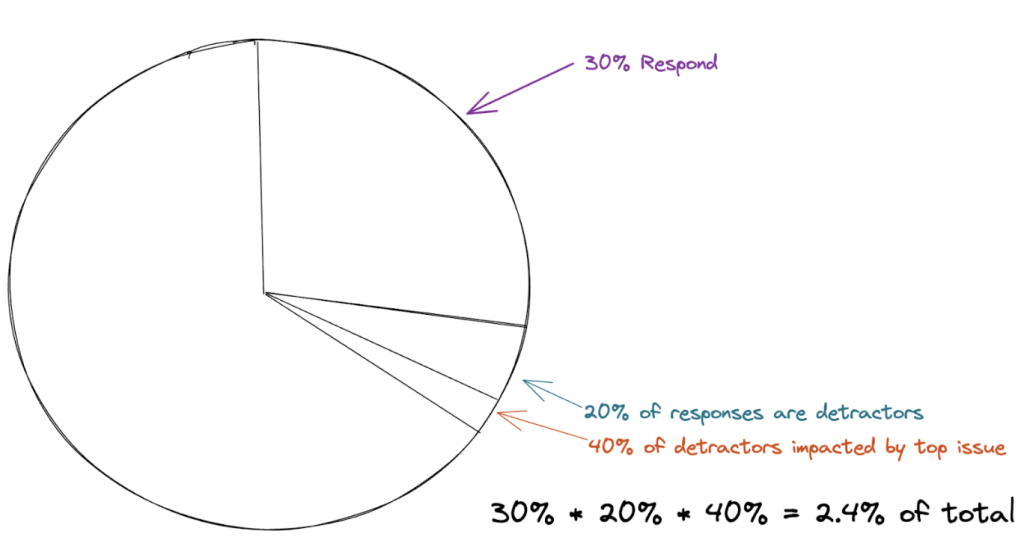

- You only get a score from 30% of your customers—a super high response rate for an NPS survey, but still a minority of your customers.

- Of those customers, maybe only 20% are detractors and give you a score between 1 and 6.

- You then take the detractors and break them down into categories showing why they rated you poorly. The top reason might impact only 40% of those.

Put those numbers together, and even if you perfectly solve the top issue driving negative NPS responses, you’re potentially still only impacting 2.4% of your total customers—even though we started with such a high response rate.

Does that sound depressing?

It shouldn’t.

That 2.4% only represents the tiny fraction of engaged customers who self-selected into taking your survey. If they’re feeling something—and if they’ll be impacted by your work on solving their issue—there’s a far greater “silent majority” out there who hasn’t yet spoken up.

To make your numbers carry more weight, you can also work out how NPS score influences purchase decisions. The math to do this will depend on a lot of company-specific factors, but the outcome could look like this:

- Promoters buy three times as much as detractors.

- A 1-point increase in NPS score reduces the risk of churn by 5%.

Unless you’re a data guru you’ll probably need help from your analytics team to get here, but it’s vital work. This data is the only way to prove the actual value of these metrics. It’s how you tie your customer surveys to business value.

Once you’re armed with this data, you can estimate the potential financial impact of any new work you do.

Translate that feedback into meaningful action

If you can start with the potential business outcome, affecting meaningful change will be significantly easier.

All you need to do is present the feedback and explain the potential gain:

- If we fix this issue, we expect to see a X% increase in NPS, which means a Y% decrease in the likelihood to churn.

- If we add this new feature, we expect to see an X% gain in CSAT, which typically correlates to a Y% increase in spend at the next renewal.

The teams responsible for doing the work can prioritize it against their roadmap. Once the new work is complete, you can use your customer surveys to measure the before-and-after to gauge the impact the work had.

With these three steps completed, you should have all the pieces for proving ROI based on any change you make to your product—all based upon feedback gathered in customer surveys.

Potential outcomes that increase ROI

Once you’ve done the foundational work above, you can begin to target the areas that will increase the ROI from your customer surveys.

Improve customer loyalty

When companies first launch, they usually maintain a close connection with their customers. That connection is almost impossible to maintain as the company gets larger. As numbers get larger, you stop interacting with individuals and see the groups instead.

The result? Companies start focusing on sterile numbers and KPIs, and begin engaging less with customer feedback.

That’s where customer surveys come in. Measuring only the spending habits of a customer means you lose sight of qualitative insights. Companies can’t accurately predict the staying power of a customer just by looking at what they’ve done so far.

Leveraging surveys is how you can identify the specific factors that impact customer loyalty.

You can target a whole host of metrics to influence customer loyalty: the rate of repeat purchases, the customer lifetime value, the upsell ratio, a customer engagement score, and so on.

If you can see an impact in any of these when you make changes based on customer feedback, you can easily prove the ROI of your customer survey platform.

Start your day

with great

quality

content

Retain customers

Depending on the industry, returning customers spend between 23-67% more than new customers.

If you can use customer surveys to identify the parts of your product that lead to your customers churning, you can work on those.

Proving ROI by retaining customers for longer is often easier to measure but, depending on how you measure it, it can take some time. For example, if you think fixing a bug will improve retention by 2% and most of your customers are on annual contracts, you may not actually know the impact for another year or more.

Increase customer satisfaction

Good customer satisfaction starts with targeting a single interaction and making it as effortless for the customer as possible.

61% of customers would switch to a competing brand after just one bad customer experience. The ROI of good experiences might not be as easy to measure—you’re more likely to prevent a bad outcome than create a good one—but they’re the prerequisite to working on retention or customer loyalty.

You can also increase customer satisfaction by reducing internal inefficiencies, such as the time your agents spend on solving a given type of issue. This approach increases the ROI of your customer survey program by helping you reduce costs and scale more efficiently.

Tools that make customer feedback digestible

Proving the return on investment of your customer surveys might feel like a complex process, but collecting data that you don’t use is (literally) useless.

Being forced to prove the ROI of your survey program brings focus to both the things that really matter to your customers and the things that will make a difference to your company.

Not collecting this type of feedback from your customers means you’re essentially ignoring them. You can optimize based exclusively on purchases and revenue, but you’ll have zero visibility on more qualitative aspects of your customer experience. You’ll miss out on how your customers feel about your product.

That’s why investing in tools that make collecting that data easy makes a huge difference. If you’re eager to start—or transform—your customer feedback program, start a free trial with Nicereply today.