Use these survey questions to capture customers’ concerns and admirations and then wow them with how you improve on what you lack and do more of what they love!

Customer Satisfaction (CSAT), Net Promoter Score (NPS), and Customer Effort Score (CES) all have their specific place inside your business.

However, the most valuable part of any survey is often not the score you receive. It’s the “why” behind the score that provides the most insight.

These survey metrics are even more powerful when they’re combined with a series of follow-up questions. These additional survey questions allow customers to give meaningful insight into why they rated your products and services the way they did.

Let’s explore some examples of survey questions you can use in your next customer-facing survey to supercharge your results and drive impactful changes that improve your customer experience across all teams in your organization.

Enhance your Customer Satisfaction Survey

Enhance your Customer Satisfaction Survey

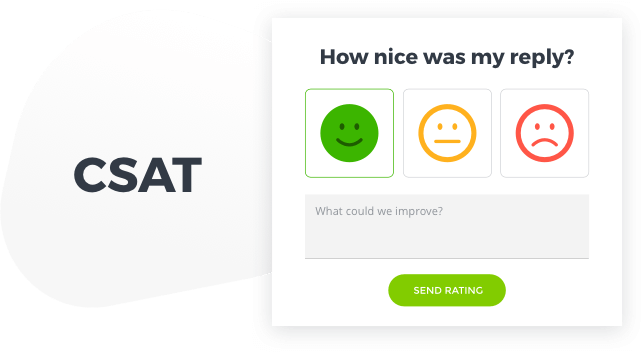

CSAT surveys are frequently used for one-off checkpoints with customers. In support, that could include how an agent performed on a ticket. For a product team, it could ask how helpful a new feature was. Or for a services organization, it could help you understand concerns with a task such as onboarding. No matter your team, CSAT is a valuable way to peek into your customer offerings. A customer’s satisfaction can have several elements that factor into the rating. These questions can help you understand which factors were most important.

Survey questions like the following can help you gauge if the customer appreciated your services:

- How can we improve our service/product?

- Did we do anything that stood out in this interaction?

- Were you told about any other services/features that were useful to you?

You can also focus on the person providing the service:

- Were you greeted professionally and treated respectfully during your interaction?

- Was the service provided promptly?

- Was the process/feature/resolution thoroughly explained to you?

- Were deadlines and promises made during the interaction met or exceeded?

And of course, you will want to check in on the outcome the customer was trying to achieve:

- Where did this interaction/feature fail to meet your expectations?

- If the problem was not solved, were appropriate alternatives or next steps given to you?

- Did this interaction set you up to succeed with our product?

Customer Satisfaction is the simplest of these customer experience metrics. Coaxing more information from a willing respondent will bring you vastly more value than only the Yes/No or 5-point scale response could ever add.

Maximize the Value of Net Promoter Score

Maximize the Value of Net Promoter Score

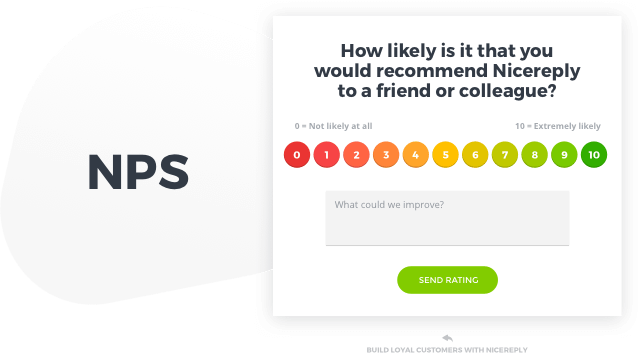

NPS often is a more holistic metric. The goal is to understand the overall impression of your company and the reasons why people would or would not recommend you to others. Since this metric has such a broad scope, you often find it paired with metadata such as the company’s size, industry, or contract value. While you can ask for this data in the survey itself, your CRM tool likely has this information already stored. So instead, focus on learning about your customer and use your survey tool to connect to your CRM to gain the complete picture.

‘Why questions’ are an excellent start to digging in deeper:

- Why did you give us this score?

- Why did you originally choose our offering?

- Why do you plan to renew your contract?

Often you want to see if your messaging and value is clear in the market:

- How do you describe our product/service to your peers or team?

- What is the most important value you gain from our product/service?

- Do our new features/products add value?

- What do our competitors do better than we do?

And then you might want to see about the future:

- How else could we provide value to your business?

- What is the next important initiative you want to undertake?

- Which area should we focus more attention on?

- What problem would you like to solve with our product that you cannot today?

And most importantly, you should always ask:

- May we contact you to discuss your feedback in more detail?

This invitation could help you turn a detractor into a promoter or help you clarify a really painful user experience and provide an opportunity to blow a customer away. Offering to listen further shows you want to engage with your end users deeply.

Digging Deep into Customer Effort

Digging Deep into Customer Effort

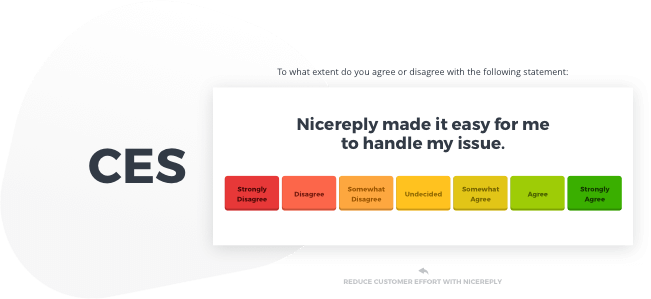

CES measures how easy it was for a customer to resolve their problem or complete the task they set out to accomplish. While typically used for support interactions, it can also help gauge a new feature or assess a process such as configuring a new account.

The idea is to understand if the actions were easy. Your customers will always run into problems, but making it easy to solve them significantly reduces customer frustration.

In a CES survey, you could start with asking specific questions about the effort itself:

- Were you able to use your preferred method of contacting our team?

- Was the service convenient to access?

- What was the most difficult or time-consuming part of this experience?

- What made this experience easy/difficult?

- Were you able to find the information you wanted easily on our website or in our app?

- Were the instructions you received clear and actionable?

- Was the effort spent on this issue in line with your expectations?

Next up, focus on alternatives, or even asking about yet to be released services:

- Would you have preferred ________? (eg. self-serving via knowledge content, chatting with us in real-time, texting our team, video-based assistance, etc.)

- What response time would you deem acceptable for your problem?

- What could we have done to improve your score by one point?

- What service or feature would have significantly improved your experience?

What do you do to make the experience easy for your customers? These questions can direct you to a UX, UI, or process change, or support adding a new channel or more knowledge base articles. Reduce friction by more thoroughly understanding where those friction points are.

Conclude your Survey

Finally, there are some questions you can ask in any survey, which helps round out the response and allow a free-form way for a customer to provide feedback without you guiding them. These questions are often left blank or filled in with “nothing to add,” but when they are used, they are a goldmine of information.

- Would you like to add anything else?

- Do you have any direct feedback for <person who provided the service>?

- In all of your experiences with us, how have we done?

Each of these long response questions allows the responder the opportunity to vent, praise, complain or strengthen their concerns without boxing themselves into a single-choice answer or a question not relevant to their experience.

Question Mix and Match

You may have noticed that some of these questions overlap or could be interchangeable. This is not an accident; after all, all of these metrics are measuring customer experience. In many cases, these questions can span survey types or be A/B tested to see which gives you the most insightful answers.

The only constant question must be the one that you ask yourself when you run these surveys:

What will we do with all of this information?

To which the answer has to be: Analyze, action, and respond.

Or, in the words of Mark Twain: “Data is like garbage. You’d better know what you are going to do with it before you collect it.” Collecting data is easy but is useless without meaningful outcomes that improve your customer experience and solve the problems shared with you.

Your customers want to provide you feedback. To help you supercharge your results and drive impactful changes, we’ve rounded up a list of survey questions & follow-up questions to one resource that you can use in your next customer-facing survey.